You’re invited to join an exclusive platform for investing in art

A portfolio that allocates 5% to contemporary art has performed better 98% of the time.

60,000+

Investors

450

Works Purchased

$1,056M+

AUM

$60M+

Distributed Back To Investors

Figures as of 06/01/2024

why art

art stands apart

It Has Historically Outperformed the S&P 500

Contemporary Art has boasted 11.5% annual returns from 1995 to 2023, outperforming the S&P 500’s 9.6% over the same period.

Artprice100© vs. S&P 500. (2000-2023)

Base 100 in January 2000

Artprice100©

S&P 500

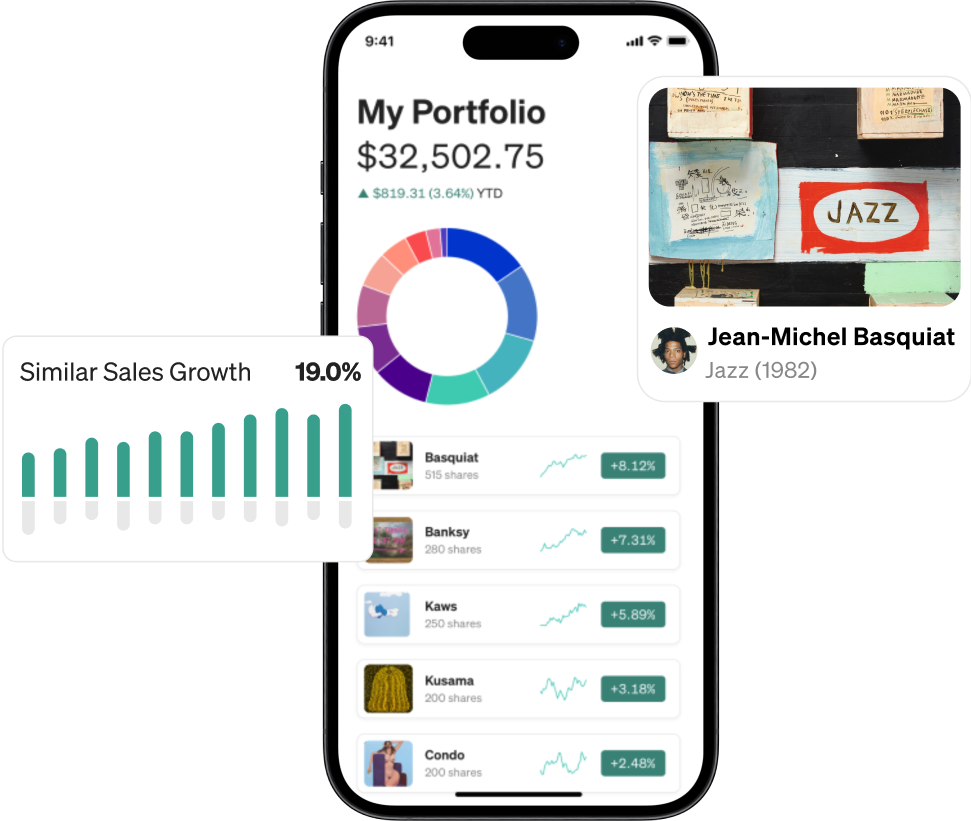

Why MASTERWORKS

Our Unfair Advantages

We strive to beat contemporary art market returns by using a proprietary data set considering 60 modern variables, and tasking a team with being in every art conversation that matters.

An Advanced ML Data Model

We analyzed millions of data points to narrow down the most indicative factors, from artist demographics and digital interest trends to price growth in similar art. We then predict growth rates for each artist, which illuminates otherwise invisible opportunities.

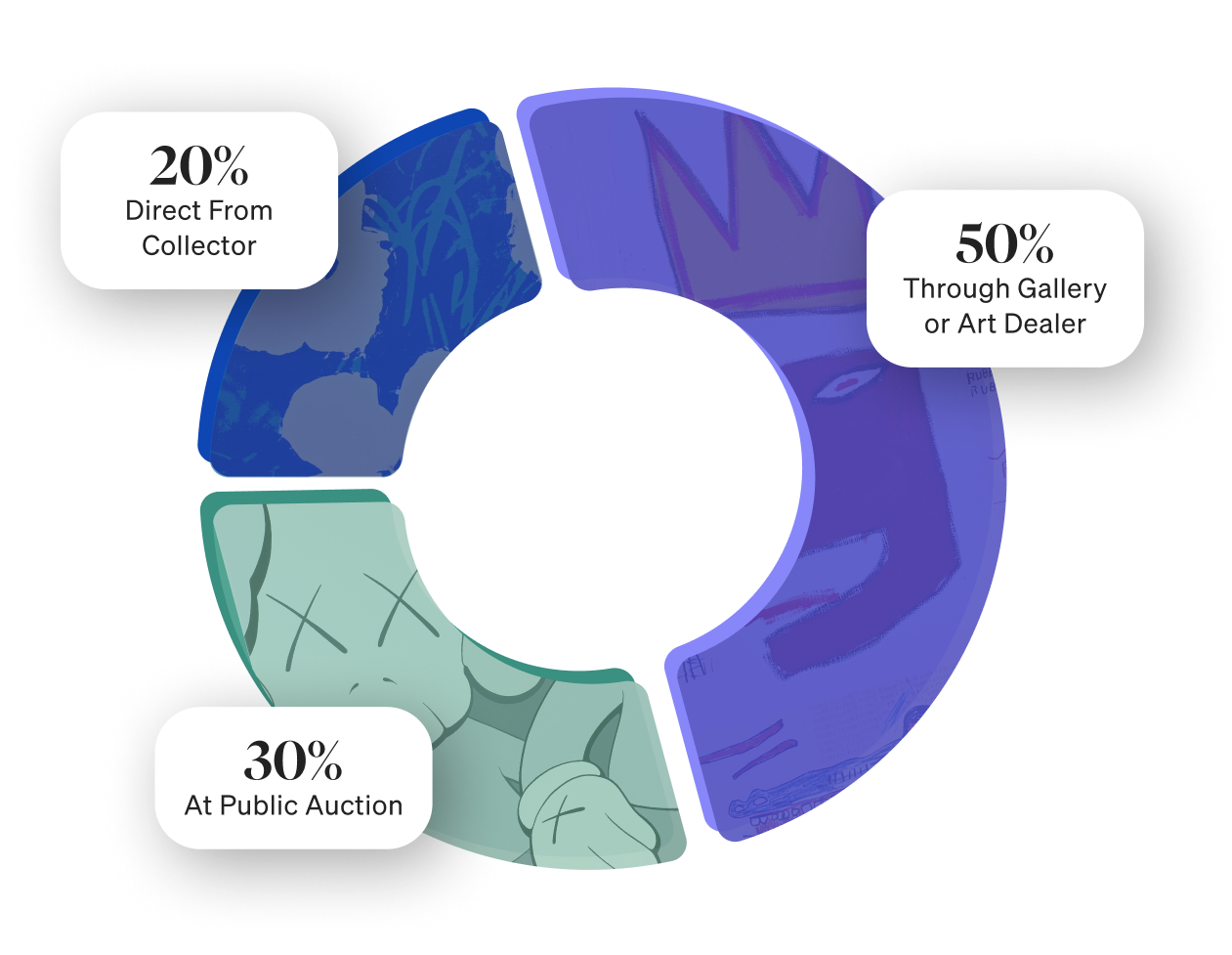

Our Art Insiders and Experts

Art trades at auction or on a handshake. We’ve assembled a global team to play this game better than anyone. We’ve bought more than 70% of our art privately, allowing us to minimize third party transaction costs, and maximize investor value.

OUR RESULTS

23 Exits, $60M+ Distributed Back So Far

Since launching in 2019, we have exited 23 paintings, all at a profit, and 1 in 7 investors has already received a payout.

Similar to most other private market asset managers, we measure our performance in terms of annualized net return (IRR) and total net return, depending on the hold period for the offering. See our exits in more detail:

Banksy

Masterworks 003, LLC

Initial Offering Size

$1,039,000

Sold For

$1,500,000

Days Held

392

IRR (net of fees)

32%

Profit from $10K investment

$3,300 after all fees

George Condo

Masterworks 003, LLC

Initial Offering Size

$1,039,000

Sold For

$1,500,000

Days Held

392

IRR (net of fees)

32%

Profit from $10K investment

$3,300 after all fees

Albert Oehlen

Masterworks 003, LLC

Initial Offering Size

$1,039,000

Sold For

$1,500,000

Days Held

392

IRR (net of fees)

32%

Profit from $10K investment

$3,300 after all fees

Banksy

Masterworks 003, LLC

Initial Offering Size

$1,039,000

Sold For

$1,500,000

Days Held

392

IRR (net of fees)

32%

Profit from $10K investment

$3,300 after all fees

George Condo

Masterworks 003, LLC

Initial Offering Size

$1,039,000

Sold For

$1,500,000

Days Held

392

IRR (net of fees)

32%

Profit from $10K investment

$3,300 after all fees

Albert Oehlen

Masterworks 003, LLC

Initial Offering Size

$1,039,000

Sold For

$1,500,000

Days Held

392

IRR (net of fees)

32%

Profit from $10K investment

$3,300 after all fees

HOW IT WORKS

Turning Art Into Assets

Our in-house research team identifies the artists and artworks we should pursue and attractive value zones in which to buy.

Our acquisitions team leverages their global network to strategically acquire top quality works from our key artist list at the most attractive prices. We primarily buy via private transactions.

We file an offering circular with the Securities and Exchange Commission (SEC), enabling us to sell shares of each artwork to the public. This creates an LLC for each piece of art that is independent of Masterworks. We insure each piece of art and then store the art in a high-security facility at the Delaware trading port.

Sign up for a free membership and we’ll pair you with an expert Advisor who will talk you through your initial investment into one or more artworks, and will suggest an allocation amount based on your portfolio. You then gain the ability to participate in any future offering (we IPO many artworks monthly) and, if based in the US, trade in our secondary market.

You can generate returns, if any, from your investment in two ways. The first is through an exit, which occurs when we sell an offering in our collection. Investors in that offering will receive a payout based on that sale’s exit price. Alternatively, you can sell your shares on the secondary trading market, and pocket any increase.

FAQs

Masterworks typically acquires ‘blue-chip’ artwork from the major auction houses, private collectors, and established galleries, with acquisitions focused on artwork representative of a top 100 artist’s mature style, that it is able to acquire at an attractive cost relative to value based on estimated historical appreciation rates, and an established track record of multiple multimillion-dollar sales annually.

Masterworks creates a Delaware LLC issuer (taxed as a partnership) and files an offering of ordinary shares with the United States SEC under Regulation A. Each issuer will use proceeds from the offering to acquire a single work of art and title to the artwork will be contributed to a Cayman Islands segregated portfolio company for the benefit of the issuer. The issuer will have no indebtedness, no other assets and will conduct no operations other than relating to the ownership, maintenance and eventual sale of the artwork. The issuer is administered by Masterworks pursuant to an administrative services agreement that provides that Masterworks pays all ordinary and necessary fees, costs and expenses in exchange for membership interests in the issuer.

Following a sale of the Painting and payment of selling expenses, the issuer entity will be liquidated, and the remaining net proceeds, if there are any, will be distributed to the then holders of record of our shares in accordance with the priorities set forth in our operating agreement.

Each single-artwork investment represents ownership of a single Painting. Masterworks typically acquires new artwork every week, allowing investors to participate in future offerings and further diversify their art investment portfolio.

We file documents with the SEC which can be obtained on www.sec.gov — you should carefully review the information contained in the offering document relating to a particular offering before investing.

If you have more questions about Masterworks or a particular Offering, you should contact us or schedule a conversation with our platform specialists.

Masterworks issuers are limited liability companies that elect to be taxed as partnerships. Each person that holds Masterworks issuer shares will be sent a Form K-1 following the end of each tax year. We do not anticipate that any Masterworks issuer will generate taxable income during any tax year, other than the tax year in which the artwork is sold and only if the artwork is sold at a profit. Title to the artwork owned by the Masterworks issuer will be vested in a Cayman Islands segregated portfolio company for the benefit of the issuer that is taxed as a corporation. We believe this structure will result in zero entity level taxation. The tax consequences to you as an investor will vary depending upon your specific circumstances. You are advised to consult with your tax advisor prior to making an investment.

We will permit non-U.S. residents to invest, except residents of countries under embargo by the United States government, however, we do not take any steps to qualify offerings in any jurisdiction other than the United States. Accordingly, you must inform yourself about and observe any restrictions that may be applicable in your country relating to your participation in a Masterworks’ offering. If you are uncertain about whether securities laws in your country restrict your participation, you should seek advice from local counsel prior to investing. As of October 2023, the Trading Market is available to residents of the United States and available only for selling current holdings to residents of France, Netherlands, Switzerland, Spain, New Zealand, Italy, India, Ireland, Portugal, Sweden, Belgium, Austria, Romania, Australia, and the United Kingdom.